https://doi.org/10.18593/race.29417

INTERFERENCE OF MACROECONOMY IN THE PERFORMANCE OF STOCK MARKETS IN LATIN AMERICA AND ASIA

Interferência da macroeconomia no desempenho dos mercados de ações na América Latina e Ásia

Edgar Maria Ferreira da Costa

E-mail: edgar96costa@hotmail.com

Graduado em Ciências Contábeis – UFGD

Endereço para contato: R. João Rosa Góes, 1761 – Vila Progresso, Dourados-MS, Brasil

https://orcid.org/0000-0001-9689-6152

Rafael Martins Noriller

E-mail: rafael.mnoriller@gmail.com

Doutor em Ciências Contábeis – UnB

Endereço para contato: R. João Rosa Góes, 1761 – Vila Progresso, Dourados-MS, Brasil

https://orcid.org/0000-0001-9981-4669

Maria Aparecida Farias de Souza Nogueira

E-mail: marianogueira@ufgd.edu.br

Doutora em Sustentabilidade Ambiental e Produtiva – UC

Endereço para contato: R. João Rosa Góes, 1761 – Vila Progresso, Dourados-MS, Brasil

https://orcid.org/0000-0001-8410-666X

Josimar Pires da Silva

E-mail: josimarnx@yahoo.com.br

Doutor em Ciências Contábeis UnB

Endereço para contato: R. João Rosa Góes, 1761 – Vila Progresso, Dourados-MS, Brasil

https://orcid.org/0000-0002-7769-8748

Artigo recebido em 08 de outubro de 2021 | Aceito em 09 de outubro de 2023

ABSTRACT

This research aims to investigate the effects of macroeconomic variables on stock market performance in Latin America and Asia. To achieve this objective, we considered data from 2000 to 2018 from nine countries located in Latin America and Asia, namely Brazil, Chile, China, India, Japan, Malaysia, Mexico, Peru, and Russia. The independent variables used in the work to determine the macroeconomic effects on the financial market were ec onomic freedom D(Ln(EF)), unemployment rate D(UNE), gross domestic product D(%ΔGDP) and exchange rate D(ER). We used the score of the local stock exchange D(SE) as a proxy for performance and as a dependent variable. Subsequently, multiple panel data regression was performed. The results show that all variables are significant at 10%. D(Ln(EF)) and D(ER) show a negative relation with D(SE), and D(UNE) and D(%ΔGDP) show a positive relation with D(SE). Important macroeconomic results with company performance.

Keywords: Panel Data, Performance, Stock Market, Newey-West, Macroeconomic variables.

RESUMO

A presente pesquisa teve por objetivo analisar o impacto das variações no desempenho do mercado de ações. Para atingir o objetivo foram considerados dados de 2000 a 2018, de nove países situados na América Latina e Ásia, sendo eles: Brasil, Chile, China, Índia, Japão, Malásia, México, Peru e Rússia. As variáveis independentes utilizadas no trabalho para encontrar os efeitos macroeconômicos sobre o mercado financeiro foram a Liberdade Econômica D(Ln(EF)), Taxa de Desemprego D(DES), Produto Interno Bruto D(%Δ PIB) e Taxa de Câmbio D(TC). Ainda foi utilizada como proxy para o desempenho e como variável dependente a Pontuação da Bolsa de Valores Local D(BOLSA). Posteriormente foi feita a regressão por dados em painel. Os resultados mostraram que todas as variáveis são significativas a 10%, sendo que D(Ln(EF)) e D(TC) apresentaram relação negativa com D(BOLSA), enquanto D(DES) e D(%Δ PIB) apresentaram relação positiva com D(BOLSA).

Palavras-chave: Panel Data, Performance, Stock Market, Newey-West, Macroeconomic variables.

1 INTRODUCTION

Financial accounting information is a tool of great importance in making managerial decisions. It makes it possible to verify the current situation of the company, provide a quantitative view, and assist in future planning (Socea, 2012). Sari and Kartika (2017) claimed that in order to achieve the desired benefits and reduce risks and uncertainties, investors need information.

The adoption of the International Financial Reporting Standards (IFRS) in Brazil had a positive impact on the Brazilian stock market, increasing the quality and quantity of information about companies and significantly improving the functioning of the Brazilian stock market (Castro; Santana, 2018). The IFRS has also a great relevance in the stock markets of China (Elshandidy, 2014). The benefits generated and the increase in value of accounting information have become higher than the cost of its application in Germany, United Kingdom and Saudi Arabia (Elbakry et al., 2017; Nurunnabi, 2018).

Thus, the financial statements must represent the company’s financial situation as faithfully as possible, so that the entity can provide information to users, such as financial market shareholders (Iasb, 2018). Thus, as verified by Peiró (2016) in France, Germany and the United Kingdom, companies are affected by macroeconomic variations. Companies listed on the stock market depend on the global situation and the country’s future prospects. Therefore, it is believed that the information disclosed in financial statements represents the real monetary condition of the entity together with the macroeconomic effects suffered by it.

Most large companies are organized as corporations, which is the most important form of business. This is associated with the ease in the transfer of ownership and the immediate withdrawal of monetary resources, which in turn is the form of financing most used by large corporations (Ross et al., 2008). This type of corporate financing is only possible due to the existence of stock markets, where companies can raise external resources from investors (Assaf Neto, 2014).

Medium and small businesses are susceptible to local policies and development, which can affect their profit positively or negatively. When dealing with large corporations that are listed in the stock market, there is a greater exposure to macroeconomic variables, which are unpredictable and inevitable. Thus, there is a concern for presidents and managers of companies to be able to identify macroeconomic variations and their impacts on the market and the entity for which they are responsible. Therefore, it must be possible to verify the macroeconomic effects on the corporation in previous periods from financial statements made available by the company.

In this sense, the following question arises: What are the effects of macroeconomic variables on the performance of equity markets in Latin America and Asia? To answer this question, the present study has the general objective of investigating the effects of macroeconomic variables on the performance of the stock market in Latin America and Asia.

The feasibility of undertaking a project depends, among other factors, on the ability to analyze and understand the macroeconomics that surrounds the market in which it operates. Thus, it is possible to avoid investments in high-risk and low financial return businesses. In the case of a company that is listed in a stock market, the analysis and comparison of macroeconomic factors with its financial performance is of great importance for its continuity. Furthermore, the company’s financial performance determines its survival in the national and/or international market.

Macroeconomics is not only linked to entities; countries and their international economic relations are of great importance to maintain a healthy trade balance and be able to control a possible exorbitant inflation. The choice for regions of Latin America and Asia is justified by the perception of the low amount of research materials related to these locations when compared to other regions, e.g., North America and Europe. The choice of countries in the sample, located in Latin America and Asia, is justified because they combine more than 70% of the total GDP of their regions.

The research goal should enable an understanding of the impacts of macroeconomic variables on corporate performance and an understanding of the importance of the ability to analyze the macroeconomic environment for companies listed in the financial market.

Considering the global market, macroeconomics is of paramount importance to everyone involved in the market, but mainly to countries, economic blocs and publicly traded companies, as it studies and seeks to relate the large aggregates. For this purpose, several indicators are needed such as inflation, exchange rate, GDP and others, from which stabilization policies can be developed (Vasconcellos, 2015).

Markevicius and Giniunaite (2016) stated that the stock markets of all countries are affected by several macroeconomic variables through cointegration and causality tests in Western Europe. This position corroborates with other studies (e.g., Bastos et al., 2009; Cebrián et al., 2019; Pandini et al., 2018; Zeitun & Tian, 2014) that have shown the same effects on several companies. However, such an impact, according to the results of previous works, is hardly analogous and constant since there are different stock markets, times, locations and market sectors. Still, in each study, the variables can affect the companies, or not, either positively or negatively.

By verifying the macroeconomic effects on corporate financial performance, Rao (2016) conducted a study with the five companies listed in the energy and oil sector of the National Stock Exchange of India (NSE), accepting the hypothesis of a significant 10% relation between financial performance and the variation of macroeconomic factors. Jareño and Negrut (2016), in a study carried out in the US stock market, questioned the relation between the stock index and macroeconomic factors, identifying significant effects of GDP, industrial production index, unemployment rate and long-term interest rate.

2.1 STOCK MARKET AND MACROECONOMIC PERSPECTIVE

Studies carried out on Europe, among them Lee et al. (2015) and Hurd et al. (2011), have found that higher expectations of future return generate a greater probability in the acquisition of shares. Corroborating this thought, Blanchard (2011) informed that any disposition to invest is related to the expectation of an increase in future profitability, since business performance is influenced by macroeconomic variables.

The study by Zhu (2012) sought to verify the macroeconomic effects on the share return of energy companies listed on the Shanghai Stock Exchange. His research found that exports have a negative relation with stock returns. However, the exchange rate, the foreign reserve and the unemployment rate showed a significant and positive relation.

Other studies have also found that macroeconomic indexes influence the price of shares given that they correspond to the market’s reaction to the different information that is provided on a country’s macroeconomics (Assefa et al., 2017; Diamandis & Drakos, 2011; Richards & Simpson, 2009; Sousa et al., 2018; Sui & Sun, 2016).

In addition, macroeconomic indexes can influence items that are used for investor decision-making, such as profitability. The study by Al-Homaidi et al. (2018) highlighted that exchange rate, interest rate, inflation and Gross Domestic Product affect companies’ profitability indexes, such as asset profitability and return on equity.

2.2 PERFORMANCE

In order to find the causal effects on macroeconomic performance in central banks, Parkin (2013) used a sample of 35 countries considered economically advanced. The results showed that countries with better control and reduced inflation had a better economic growth.

The work of Ebaidalla (2014) sought to find the impacts of exchange rate volatility on macroeconomic performance. Economic growth, foreign direct investment and trade balance were used as the main indicators. From the analysis of the results, it was possible to identify that the volatile exchange rate has negative effects on the flow of financial investments and on economic growth.

In addition, Ojo and Alege (2014) also sought to understand what affects countries’ macroeconomic performance based on exchange rate fluctuations. Their research results showed a bidirectional relation to the exchange rate and other variables such as interest rate, price index and the degree of economic openness, which corroborates the findings of Shaheen (2013) and diverges from the research by Goyal (2012) regarding bilateral relations, but it contributes by verifying a positive relation for macroeconomic performance.

Mehran (1995) commented in his research that the most appropriate proxy found in the literature to verify the performance of the organization is the use of share return. The studies by Yasser et al. (2011) confirmed it. However, according to Mehran (1995), this proxy is more effective when it occurs in companies with total shareholding.

It is possible to find relations and effects of macroeconomics in the stock markets in different regions of the world (Abugri, 2008; Gupta & Modise, 2013; Peiró, 2016; Quadir, 2012; Zhu, 2012), making even predictive share return analyses possible (Asgharian et al., 2013; Gupta & Modise, 2013).

Therefore, based on the studies found and knowing that the performance measure can be obtained from various indexes, we decided to use the stock return of stock markets with the highest trading flows as a proxy for performance.

2.3 SUPPORTING HYPOTHESES

2.3.1 Economic opening

For Chen and Huang (2009), economic freedom is given by how much one can perform an economic activity with minimal government interference. According to their study, variables such as protection for shareholders and the country’s legal environment help to create a positive relation between economic freedom and shareholder returns, using multiple regression.

To this end, the Economic Freedom of the World (EFW) index was created. The project was developed by Gwartney (2009). By analyzing 100 countries, Gwartney (2009) identified some issues regarding the index of economic freedom in his study. Among these issues, it was possible to verify that countries with greater economic freedom have a greater private investment within the GDP, as well as increased productivity, faster growth, higher per capita income and poverty reduction when compared to countries with less economic freedom.

In a national analysis, Bujancã and Ulman (2015) found that countries considered highly economically free have a greater competitiveness in the market. To carry out the study, data from the EFW index, made available by the Fraser Institute and collected in 2012, were used. Together with this analysis, it was also possible to identify that unemployment rate, productivity, trade balance, among other characteristics, are directly affected by economic freedom.

The research by Yildirim and Gökalp (2016) used twenty-three institutional structure variables in developing countries to verify macroeconomic performance, using multiple regression. Based on the results obtained, it was possible to identify that the variables related to the country’s economic opening, such as regulations on trade barriers, participation of the private sector in the banking system and a low restriction of foreign investment, presented a positive relation regarding the performance of developing countries.

In contrast, Setayesh and Sheidaee (2016) conducted a study in twelve countries in Asia and the Pacific from 2002 to 2012 to verify the effects of economic freedom on stock market return using the EFW index published in 2014 by the Fraser Institute. However, the results showed no correlation between these two variables, which corroborates the findings of Chen and Huang (2009), who used the Index of Economic Freedom (EF) published by the Heritage Foundation and the Wall Street Journal. However, at the same time, Chen and Huang (2009) identified that economic openness is linked to less volatility in the stock market. Therefore, There is a positive relation between economic freedom and performance.

2.3.2 Unemployment

At first, the work of Boyd et al. (2005) brought to the discussion the relation between the news of unemployment and the reaction of the stock market in the short term. The results showed that, on average, news of a rising unemployment rate had negative effects when the market is in economic contraction, while there are positive effects when the market is in economic expansion. Boyd et al. (2005) argued that this increase in unemployment rate is a future indication of lower corporate profits and lower interest rates.

Also conducting a short-term analysis, Gonzalo and Taamouti (2012) sought to verify by quartiles the non-linearity in the stock market’s reaction to an anticipated and unforeseen unemployment rate using Granger causality and tests based on quantile regression. According to the results, the increase in early unemployment rate has a significant impact on the stock price, raising its price. As an explanation, Gonzalo and Taamouti (2012) analyzed the relation between unemployment rate and the Federal Reserve (Fed). In that study, it was possible to identify that unemployment rate is followed by the Fed’s monetary policy, which reduces the interest rate, causing an increase in stock exchange prices.

As for long-term analyses, the research by Jareño and Negrut (2016) aimed to understand the relation between the economic cycle and the evolution of the stock market in multiple regression. The results obtained showed that it is possible to verify a significant and negative relation between the stock price and the increase in unemployment rate.

Holmes and Maghrebi (2016) identified that an increase in the uncertainty of stock return leads to an increase in the unemployment rate. There is also the work of Mollick and Faria (2008), who, using Tobin’s Q, found a significant and negative coefficient in relation to unemployment rate.

Finally, it was possible to verify in the literature the effects of unemployment rate on the stock market in both the short and long term. For the most part, unemployment rate has a negative and statistically significant relation with the stock market. Therefore,: The unemployment rate has a negative relation with performance.

2.3.3 Gross domestic product

The GDP is the most used indicator for verifying and analyzing the growth of a given country over time or comparing countries. It can be determined by the value of the final goods and services produced or by the sum of the added values in the economy in a country for a specific period (Blanchard, 2011; Vasconcellos, 2015).

Berger et al. (2004) verified that a high GDP is related to a higher degree of market share, in which the economic performance of community banks is positively related to GDP growth. Following the reasoning, the increase in GDP itself causes an appreciation of companies in the stock market; their growth increases the expected cash flow and performance using quantitative approach (Hussin et al., 2012; Jareño & Negrut, 2016).

The research by San and Heng (2013) showed that GDP growth is not a determinant to profitability in Malaysian banks and reported the possibility that banks operating in different macroeconomic environments are affected by other macroeconomic variables. The study by Rashid and Jabeen (2016) found a negative relation between GDP and the performance of financial institutions. In contrast, studies were found that verify a positive effect of GDP on the profitability of financial institutions and companies in the insurance sector (Curak et al., 2012; Banerjee & Majumdar, 2018; Petria et al., 2015).

Therefore, according to the studies mentioned, the Gross Domestic Product has a very strong trend of positive effects on the financial performance of companies. However, there is still the possibility, despite low, of a negative relation. Therefore, : There is a positive relation between GDP and performance.

2.3.4 Exchange rate

The exchange rate plays a fundamental role in economic stability and external balance. Fluctuations occur constantly. The exchange rate has general causes in the economy, affecting the level of production and employment, exports, imports, and international financial capital movement (Blanchard, 2011; Vasconcellos, 2015).

Murungi (2014) identified a relation between the exchange rate and the financial performance of companies in Kenya using descriptive analysis, correlation analysis and multiple regression. This causality may vary according to the currency used and whether it shows appreciation or devaluation. Confirming the work of Hussin et al. (2012), the research by Ćorić and Pugh (2010) managed to identify factors that help to explain the extremes in positive and negative relations of the exchange rate with the international market, and adds by stating that on average the exchange rate variability has a negative relation with international trade using quantitative approach.

The research by Acaravci and Çalim (2013) carried out on the Turkish banking sector used three models: model 1 for a state bank, model 2 for a private bank, and model 3 for a foreign bank using cointegration test approach. The model 2 had a negligible impact, while models 1 and 3 showed a positive and significant relation with performance.

Regarding the food sector, Lee (2018) found a negative and significant relation between exchange rate and financial performance using multiple regression. This relation was because the dollar is increasingly stronger than the Brunei currency, which is causing instability in the price of raw materials. Hasan et al. (2019) conducted a study on insurance companies in Bangladesh and found no significant relations between exchange rate and performance in panel data regression metrodology.

Finally, according to most of the studies mentioned, it is possible to verify a significant relation between exchange rate and the performance of companies. However, whether this relation is positive or negative depends on the currencies used in the valuation and the trade balance situation between these countries. However, in most studies, there was a negative and significant relation between the exchange rate and performance. Therefore,: There is a significant and negative relation between exchange rate and performance.

3 METHODOLOGICAL PROCEDURES

Scientific research is based on a set of systematic procedures based on logical reasoning, seeking solutions to problems and questions, but always using scientific methods (Andrade, 2010). This work is quantitative, which, according to Creswell (2010), is a method for testing objective theories from the analysis of the relation between variables, e.g., macroeconomic variables (interest rate, exchange rate and GDP) and the use of instruments to measure variables, enabling analyzes based on the results found. The research used a hypothetical-deductive method.

This work is also classified as descriptive, as there is no interference by the researcher in the facts, which will be recorded, classified and interpreted. In descriptive research, there is also an establishment of relations between variables, which often aim to determine the nature of these relations (Gil, 2008).

The present work considered the stock exchange of Brazil, Chile, China, India, Japan, Malaysia, Mexico, Peru, and Russia, which present the largest volume of negotiations in the financial market. The analysis period comprises an annual time frame from 2000 to 2018 aiming to increase the number of observations that, consequently, will allow a better analysis of the results.

Macroeconomic data in line with business data were collected from 2000. The macroeconomic variables were (i) economic freedom, (ii) unemployment rate, (iii) Gross Domestic Product, and (iv) exchange rate. Finally, data collection will be carried out considering the annual period in face of the difficulty in collecting quarterly or monthly data.

Initially, we intended to access the official websites of each stock exchange in the sample to collect data. However, due to the difficulty of finding them and obtaining data, the collection of points of each exchange took place from the website investing.com, which is a platform of financial markets with international relevance and presents the necessary data for this research.

In turn, the other data were obtained from the World Bank (macroeconomic data) and the website heritage.org/index because they have great relevance and worldwide reliability. All data were collected manually.

Initially, descriptive statistics of the research data were performed. Subsequently, a multiple regression was carried out seeking to verify the importance of macroeconomic variables (economic freedom, unemployment rate, exchange rate and GDP) in the performance of the stock market.

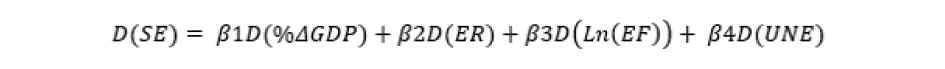

Therefore, multiple panel data regression, the dependent variable performance is the score of the local stock exchange. The variables exchange rate (expressed in USD) and the gross domestic product (expressed in national currency) were deflated. The calculation formula to measure the performance of the Local Stock Exchange Score is:

Where,

SE = Measured by the first difference in the score of the local stock exchange

EF (Economic Freedom Index) = Measured by the first difference in economic freedom.

UNE = Measured by the first difference in the unemployment rate

GDP = Measured by the percentage change in Gross Domestic Product.

ER = Measured by the first exchange rate difference

Multiple panel data regression is important because it overcomes possible econometric problems by considering larger samples. Considering the autocorrelation problem, the Newey-West (NW) technique was used. The variables and their measurements are summarized and justified in Table 1.

Chart 1

Summary of variables

|

Variable |

Expected Sign |

Justification |

|

Explanatory Variable |

||

|

Economic freedom (EF) |

Positive |

Countries with a greater economic freedom have a greater private investment within the GDP, as well as increased productivity, faster growth, higher per capita income and poverty reduction, when compared to countries with less economic freedom (Gwartney, 2009); countries considered highly economically free have a greater competitiveness in the market (Bujancã & Ulman, 2015). |

|

Unemployment rate (UNE) |

Negative |

The results showed that, on average, news of a rising unemployment rate had negative effects when the market is in economic contraction, while there are positive effects when the market is in economic expansion (Boyd et al., 2005). Gonzalo and Taamouti (2012) found that the increase in the early unemployment rate has a significant impact on the stock price, raising its price. The unemployment rate is followed by the monetary policy, which lowers the interest rate, causing an increase in stock market prices (Gonzalo & Taamouti, 2012). However, by relating the economic cycle and the evolution of the stock market, it is possible to verify a significant and negative relation between the share price and the increase in unemployment rate (Jareño & Negrut, 2016), converging with most studies (Holmes & Maghrebi, 2016; Mollick & Faria, 2008). |

|

Percentage variation in Gross Domestic Product (GDP). |

Positive |

The GDP is the most used indicator to verify and analyze a country’s growth over time (Blanchard, 2011; Vasconcellos, 2015). Thus, a high GDP is related to a greater degree of market share; the economic performance is positively related to GDP growth (Berger et al., 2004) so that the increase in GDP causes an appreciation of companies listed in the stock market, and their growth increases the expected cash flow and performance (Hussin et al., 2012; Jareño & Negrut, 2016). |

|

Exchange rate (ER) |

Negative |

The exchange rate has general causes in the economy, impacting the level of production and employment, exports, imports and international financial capital movement (Blanchard, 2011; Vasconcellos, 2015). In general, exchange rate variability has a negative relation with international trade (Hussin et al., 2012; Ćorić & Pugh, 2010) possibly because the dollar is increasingly stronger than local currencies, which causes instability in the price of raw materials (Lee, 2018). |

4 ANALYSIS AND DISCUSSION OF RESULTS

Table 1 presents the results of descriptive statistics and the variables used in the research. Thus, it is possible to verify that (i) the stock exchange presented an average variation of 1,383 points; (ii) the unemployment rate showed an average decrease of 0.067%, evidencing a reduction in unemployment over the analyzed period; (iii) the ER shows an average price variation of 1,116 currency units; (iv) regarding the %ΔGDP, there was a decrease of 0.12%, a value close to the median -0.15%; (v) the EF presented a considerably low, but positive result in the mean and median 0.0022; (vi) finally, all the research variables showed high standard deviations.

Table 1

Descriptive Statistics

|

Variable |

Mean |

Median |

Standard Deviation |

Maximum |

Minimum |

|

D(SE) |

1,383 |

855 |

6,074 |

31,038 |

-26,335 |

|

D(UNE) |

5.218 |

4.500 |

2.421 |

12.827 |

2.268 |

|

D(ER) |

1.063 |

3.95 |

17.88 |

95.35 |

-131.63 |

|

GDP |

4.335 |

4.495 |

3.431 |

14.231 |

-7.799 |

|

EF |

0.131 |

0.200 |

1.756 |

6.500 |

-5.800 |

Notes: ER = first exchange rate difference; GDP = first difference in the percentage change in GDP; UNE = first difference in the unemployment rate; EF = first difference in economic freedom.

In turn, Table 2 highlights the correlations between the study variables. It is worth mentioning that Variance Inflation Factor (VIF) tests were not reported, highlighting that multicollinearity is not a problem for the research estimates. In general, the variables showed very low correlations, either positive or negative. Specifically, the highest correlation found was between D(%ΔGDP) and D(UNE).

Table 2

Correlation of variables

|

VARIABLE |

D(UNE) |

D(ER) |

D(%ΔGDP) |

D(Ln(EF)) |

|

D(SE) |

0.22 |

-0.003 |

-0.11 |

-0.12 |

|

D(UNE) |

-0.04 |

-0.22 |

-0.17 |

|

|

D(ER) |

|

|

-0.13 |

0.01 |

|

D(%ΔGDP) |

|

|

|

-0.002 |

As for autocorrelation, the Durbin-Watson (DW) test highlighted the existence of autocorrelation. As for heteroscedasticity, data were estimated with white correction (diagonal). Finally, for normality, the central limit theorem was used as a support, in which samples greater than 100 observations tended towards normality (Gujarati & Porter, 2011). Justified by the autocorrelation problem, the Newey-West (NW) technique was used.

Table 3

Results for D(SE)

|

VARIABLE |

A |

|

D(%ΔGDP) |

299.6** |

|

D(UNE) |

2,945.9** |

|

D(ER) |

-21.3* |

|

D(Ln(EF)) |

-27,931.6* |

|

C |

1,715.0*** |

|

Estimate |

NW |

|

R2 |

0.108 |

|

F |

4.39 (0.0000) |

* Statistically significant indicators at 1% (P<0.01)

** Statistically significant indicators at 5% (P<0.05)

*** Statistically significant indicators at 10% (P<0.10)

Table 3 presents the results of the effects of explanatory variables for the dependent variable D(SE), obtained using the multiple regression statistical technique, using the approach proposed by NW due to the presence of autocorrelation. The results showed that the variable D(Ln(EF)) has a negative and significant relation at 10%, not confirming , contrary to the studies by Gwartney (2009), Bujancã and Ulman (2015), and Yildirim and Gökalp (2016). In other words, the greater the economic freedom, the lower the performance of the stock market. This unexpected result can be justified by characteristics intrinsic to the countries of the research sample and by the period of analysis (i.e., different from the studies analyzed in this research).

Next, D(UNE) presented a positive and significant relation at 5% with the performance metric, rejecting . The results are in line with the works of Boyd et al. (2005) and Gonzalo and Taamouti (2012). As for the justification, we can identify from the data obtained that there was an expansion of the stock market during the analysis period together with a considerable increase in the unemployment rate in the same period, as explained by Boyd et al. (2005).

Subsequently, the variable D(%ΔGDP) showed a positive and significant relation at 5% in the model proposed in this research. Therefore, it corroborates the works of Berger et al. (2004), Hussin (2012) and Jareño and Negrut (2016), carried out with different samples and periods, confirming .

In turn, the variable D(ER) showed a negative and significant relation at 10%, confirming and corroborating the works of Ćorić and Pugh (2010) and Lee (2018). As shown by Murungi (2014), the currencies that make up the sample are devalued when compared to the dollar, the monetary unit used as the basis for our study, justifying the result found.

In short, the GDP and exchange rate hypotheses were confirmed, while the hypotheses of economic freedom and unemployment rate were not. Thus, the interference of macroeconomics in the stock market performance of local markets stands out. Each region analyzed in the sample has its specificities and a volatility over time.

As for R2, it was approximately 10.8%, considered important in determining the performance of the stock market with respect to the macroeconomic impact. The model also considered the F test. Still, the constant presented a positive and significant relation at 1% in the model adopted. In practical terms, the work highlights the importance of considering macroeconomics in company performance. Furthermore, the relationship may be important as a guide for company management and also for governments.

5 FINAL CONSIDERATIONS

In view of the research objective, i.e., to determine the effects of macroeconomic variables on the performance of the stock market, it is possible to state from the four research hypotheses that there is a relation/effect of macroeconomics on stock returns. The study included five variables from nine countries and a period of nineteen years (2000 to 2018). The research used multiple regression with panel data, considering estimation by NW. Hypotheses 3 and 4 were confirmed, corroborating the research highlighted in the work.

The hypotheses of GDP and exchange rate were confirmed, while the hypotheses of economic freedom and unemployment rate were rejected. All variables presented a statistical significance at 10%. The results show that, in general, (i) the economic freedom of the group of countries that make up the sample is not advantageous, (ii) a higher unemployment rate in these regions contributes to the performance of the stock market, (iii) GDP growth contributes to a better performance of the stock market in their respective countries, and (iv) as the currencies that compose the sample are devalued in comparison to the dollar, higher exchange rates negatively affect their stock markets.

Difficulties were found during the work. Thus, limitations arise because there is no possibility of accessing database software. The information was collected manually from different locations. The search for the necessary data presented barriers regarding the style of the platforms and the arrangement of the information, which is not standardized.

As a suggestion for further research, studies need to (i) analyze a longer period of data, (ii) confront developed countries with developing countries, (iii) carry out analyses by business sectors at the expense of the grouped approach, and (iv) adopt another performance proxy and add other macroeconomic variables in the survey, e.g., interest rate and trade balance.

REFERENCES

Abugri, B. A. (2008). Empirical relationship between macroeconomic volatility and stock returns: Evidence from Latin American markets. International Review Of Financial Analysis, 17(2), 396-410. Elsevier BV. http://dx.doi.org/10.1016/j.irfa.2006.09.002. https://www.sciencedirect.com/science/article/pii/S1057521906000731

Acaravci, S. K., & Çalim, A. E. (2013). Turkish Banking Sector’s Profitability Factors. International Journal Of Economics And Financial Issues, 3(1), 27-41.

Al-Homaidi, E. A., Tabash, M., Farhan, N. H. S., & Almaqtari, F. A. (2018). Bank-specific and macro-economic determinants of profitability of Indian commercial banks: A panel data approach. Cogent Economics & Finance, 6(1), 1-26.

Andrade, M. M. (2010). Introdução à metodologia do trabalho científico: elaboração de trabalhos na graduação. (10ª ed.). São Paulo: Atlas.

Asgharian, H., Hou, A. J., & Javed, F. (2013, 22 Julho). The Importance of the Macroeconomic Variables in Forecasting Stock Return Variance: A GARCH-MIDAS Approach. Journal Of Forecasting, 32(7), 600-612. Wiley. http://dx.doi.org/10.1002/for.2256. https://onlinelibrary.wiley.com/doi/full/10.1002/for.2256

Assaf Neto, A. (2014). Finanças corporativas e valor. (7ª ed.). São Paulo: Atlas.

Assefa, T. A., Esqueda, O. A., & Mollick, A. V. (2017). Stock returns and interest rates around the World: A panel data approach. Journal of Economics and Business, 89, 20-35.

Banerjee, R., & Majumdar, S. (2018). Impact of firm specific and macroeconomic factors on financial performance of the UAE insurance sector. Global Business And Economics Review, 20(2), 248-261. http://dx.doi.org/10.1504/gber.2018.090091.

Bastos, D. D., Nakamura, W. T., & Basso, L. F. C. (2009, Dezembro). Determinantes da estrutura de capital das companhias abertas na américa latina: um estudo empírico considerando fatores macroeconômicos e institucionais. Ram. Revista de Administração Mackenzie, 10(6), 47-77. http://dx.doi.org/10.1590/s1678-69712009000600005.

Berger, A. N., Hasan, I., & Klapper, L. F. (2004, Abril). Further Evidence on the Link between Finance and Growth: An International Analysis of Community Banking and Economic Performance. Journal Of Financial Services Research, 25(2/3), 169-202. http://dx.doi.org/10.1023/b:fina.0000020659.33510.b7.

Blanchard, O. (2011). Macroeconomia. (5ª ed.). São Paulo: Pearson Prentice Hall.

Boyd, J. H., Hu, J., & Jagannathan, R. (2005, 2 Março). The Stock Market’s Reaction to Unemployment News: Why Bad News Is Usually Good for Stocks. The Journal Of Finance, 60(2), 649-672. http://dx.doi.org/10.1111/j.1540-6261.2005.00742.x.

Bujancã, G.-V., & Ulman, S.-R. (2015). The Impact of the Economic Freedom on National Competitiveness in the Main Economic Power Centres in the World. Procedia Economics And Finance, 20, 94-103. http://dx.doi.org/10.1016/s2212-5671(15)00052-0.

Castro, F. H., & Santana, V. (2018, Dezembro). Informativeness of stock prices after IFRS adoption in Brazil. Journal Of Multinational Financial Management, 47-48, 46-59. http://dx.doi.org/10.1016/j.mulfin.2018.09.001.

Cebrián, F. J., López, A. M. E., & Cuenca, A. (2019, Março). Macroeconomic variables and stock markets: an international study. Euro-american Association Of Economic Development Studies, 19(1), 43-57. http://hdl.handle.net/10578/20151.

Chen, C. R., & Huang, Y. S. (2009, 23 Outubro). Economic freedom, equity performance and market volatility. International Journal Of Accounting & Information Management, 17(2), 189-197. http://dx.doi.org/10.1108/18347640911001221.

Ćorić, B., & Pugh, G. (2010, Agosto). The effects of exchange rate variability on international trade: a meta-regression analysis. Applied Economics, 42(20), 2631-2644. http://dx.doi.org/10.1080/00036840801964500.

Creswell, J. W. (2010). Projeto de pesquisa: métodos qualitativo, quantitativo e misto. (3ª ed.). Porto Alegre: Artmed.

Curak, M., Poposki, K., & Pepur, S. (2012). Profitability Determinants of the Macedonian Banking Sector in Changing Environment. Procedia – Social And Behavioral Sciences, 44, 406-416. http://dx.doi.org/10.1016/j.sbspro.2012.05.045.

Diamandis, P. F., & Drakos, A. A. (2011). Financial liberalization, exchange rates and stock prices: Exogenous shocks in four Latin America countries. Journal of Policy Modeling, 33(3), 381-394.

Ebaidalla, E. (2014). Impact of exchange rate volatility on macroeconomic performance in Sudan. Journal of Development and Economic Policies, 16(1), 73-105. https://www.researchgate.net/profile/Ebaidalla_Ebaidalla/publication/273574755_IMPACT_OF_EXCHANGE_RATE_VOLATILITY_ON_MACROECONOMIC_PERFORMANCE_IN_SUDAN/links/5505d49f0cf231de077784cb.pdf.

Elbakry, A. E., Nwachukwu, J. C., Abdou, H. A., & Elshandidy, T. (2017). Comparative evidence on the value relevance of IFRS-based accounting information in Germany and the UK. Journal Of International Accounting, Auditing And Taxation, 28, 10-30. http://dx.doi.org/10.1016/j.intaccaudtax.2016.12.002.

Elshandidy, T. (2014, Junho). Value relevance of accounting information: Evidence from an emerging market. Advances In Accounting, 30(1), 176-186. http://dx.doi.org/10.1016/j.adiac.2014.03.007.

Gil, A. C. (2008). Métodos e técnicas de pesquisa social. (6ª ed.). São Paulo: Atlas.

Gonzalo, J., & Taamouti, A. (2012). The reaction of stock market returns to anticipated unemployment. https://e-archivo.uc3m.es/handle/10016/16310.

Goyal, A. (2012). Exchange rate regimes and macroeconomic performance in South Asia. https://www.researchgate.net/profile/Ashima_Goyal2/publication/46476562_Exchange_Rate_Regimes_and_Macroeconomic_Performance_in_South_Asia/links/55f13f1a08ae0af8ee1d5048.pdf.

Gupta, R., & Modise, M. P. (2013, Janeiro). Macroeconomic Variables and South African Stock Return Predictability. Economic Modelling, 30, 612-622. http://dx.doi.org/10.1016/j.econmod.2012.10.015.

Gujarati, D. N., & Porter, D. C. (2011). Econometria básica-5. São Paulo. Amgh Editora.

Gwartney, J. (2009). Institutions, economic freedom, and cross-country differences in performance. Southern Economic Journal, 75(4), 937-956. Gale Academic Onefile. https://link.gale.com/apps/doc/A199684328/AONE?u=capes&sid=AONE&xid=2e93392b.

Hasan, B., Islam, N., & Wahid, A. N. M. (2019, 30 Janeiro). The effect of macroeconomic variables on the performance of non-life insurance companies in Bangladesh. Indian Economic Review, 1-15. http://dx.doi.org/10.1007/s41775-019-00037-6.

Holmes, M. J., & Maghrebi, N. (2016, Junho). Financial market impact on the real economy: An assessment of asymmetries and volatility linkages between the stock market and unemployment rate. The Journal Of Economic Asymmetries, 13, 1-7. http://dx.doi.org/10.1016/j.jeca.2015.10.003.

Hurd, M., Van Rooij, M., & Winter, J. (2011, 23 Março). Stock market expectations of Dutch households. Journal of Applied Econometrics, 26(3), 416-436. Wiley. http://dx.doi.org/10.1002/jae.1242.

Hussin, M. Y. M., Muhammad, F., Abu, M. F., & Awang, S. A. (2012). Macroeconomic variables and Malaysian Islamic stock market: a time series analysis. Journal of Business Studies Quarterly, 3(4), 1-13. https://jbsq.org/wp-content/uploads/2020/07/JBSQ-Ideal-Article.pdf.

International Accounting Standard Board. (2018). IAS 1 – Presentation of finacial statements. https://www.iasplus.com/en/standards/ias/ias1.

Jareño, F., & Negrut, L. (2016). US stock market and macroeconomic factors. Journal of Applied Business Research, 32(1), 325. https://previa.uclm.es/profesoradO/fjareno/DOCS/9541-36008-2-PB.pdf.

Lee, B., Rosenthal, L., Veld, C., & Veld-Merkoulova, Y. (2015, Julho). Stock market expectations and risk aversion of individual investors. International Review Of Financial Analysis, 40, 22-131. http://dx.doi.org/10.1016/j.irfa.2015.05.011.

Lee, X. H. (2018). Apollo Food Holdings Berhad: The Relationship between Performance and Internal, External Determinants. Ssrn Electronic Journal, 1-20. http://dx.doi.org/10.2139/ssrn.3182175.

Markevicius, A., & Giniunaite, L. (2016). The influence of macroeconomic factors on the stock markets in the Baltic countries and Western Europe-A comparison. Master’s Programme in Finance Lund University.

Mehran, H. (1995, Junho). Executive compensation structure, ownership, and firm performance. Journal Of Financial Economics, 38(2), 163-184. http://dx.doi.org/10.1016/0304-405x(94)00809-f.

Mollick, A. V., & Faria, J. R. (2008, 21 Janeiro). Capital and labor in the long-run: evidence from Tobin’s q for the US. Applied Economics Letters, 17(1), 11-14. http://dx.doi.org/10.1080/13504850701719819.

Murungi, D. U. (2014). Relationship between macroeconomic variables and financial performance of insurance companies in kenya. [Dissertação de Mestrado, Curso de Master’s Degree In Finance, University Of Nairobi, Nairobi].

Nurunnabi, M. (2018, Outubro). Perceived costs and benefits of IFRS adoption in Saudi Arabia: An exploratory study. Research In Accounting Regulation, 30(2), 166-175. http://dx.doi.org/10.1016/j.racreg.2018.09.001.

Ojo, A. T., & Alege, P. O. (2014). Exchange rate fluctuations and macroeconomic performance in sub-Saharan Africa: A dynamic panel cointegration analysis. Asian Economic and Financial Review, 4(11), 1573. https://www.researchgate.net/profile/Philip_Alege/publication/275407158_EXCHANGE_RATE_FLUCTUATIONS_AND_MACROECONOMIC_PERFORMANCE_IN_SUB-SAHARAN_AFRICA_A_DYNAMIC_PANEL_COINTEGRATION_ANALYSIS_Asian_Economic_and_Financial_Review/links/553b84520cf2c415bb094ee7.pdf.

Pandini, J., Stüpp, D. R., & Fabre, V. V. (2018, 8 Agosto). Análise do impacto das variáveis macroeconômicas no desempenho econômico-financeiro das empresas dos setores de Consumo Cíclico e Não Cíclico da BM&Fbovespa. Revista Catarinense da Ciência Contábil, 17(51), 7-22. http://dx.doi.org/10.16930/2237-7662/rccc.v17n51.2606.

Parkin, M. (2013). The effects of central bank independence and inflation targeting on macroeconomic performance: Evidence from natural experiments. EPRI Working Paper. https://www.econstor.eu/handle/10419/123488.

Peiró, A. (2016, Janeiro). Stock prices and macroeconomic factors: Some European evidence. International Review Of Economics & Finance, 41, 287-294. http://dx.doi.org/10.1016/j.iref.2015.08.004.

Petria, N., Capraru, B., & Ihnatov, I. (2015). Determinants of Banks’ Profitability: Evidence from EU 27 Banking Systems. Procedia Economics And Finance, 20, 518-524. http://dx.doi.org/10.1016/s2212-5671(15)00104-5.

Quadir, M. M. (2012). The effect of macroeconomic variables on stock returns on Dhaka stock exchange. International Journal of Economics and Financial Issues, 2(4), 480-487. https://dergipark.org.tr/en/pub/ijefi/issue/31955/351865.

Rao, D. T. (2016). The relationship of macroeconomic factors and financial performance of the five firms listed in the energy and petroleum sector of the NSE. [Tese de Doutorado, Curso de Administração, Strathmore University]. http://su-plus.strathmore.edu/handle/11071/4752.

Rashid, A., & Jabeen, S. (2016, Junho). Analyzing performance determinants: Conventional versus Islamic Banks in Pakistan. Borsa Istanbul Review, 16(2), 92-107. http://dx.doi.org/10.1016/j.bir.2016.03.002.

Richards, N. D., & Simpson, J. (2009, Fevereiro). The Interaction between Exchange Rates and Stock Prices: An Australian Context. International Journal Of Economics And Finance, 1(1), 3-23.

Ross, S. A., Westerfield, R., & Jordan, B. D. (2008). Fundamentals of corporate finance. Tata McGraw-Hill Education.

San, O. T., & Heng, T. B. (2013, 28 Fevereiro). Factors affecting the profitability of Malaysian commercial banks. African Journal Of Business Management, 7, 649-660.

Sari, L. N. I., & Kartika, T. P. D. (2017). Effect of profitability, leverage, and corporate social responsibility (csr) on investor reactions. E-Jurnal Spirit Pro Patria, 3(1), 1-22.

Setayesh, M. H., & Sheidaee, S. (2016). Investigation of the Effect of Economic Freedom on Stock Market Volatility. International Journal of Humanities and Cultural Studies (IJHCS), 1(1), 804-813. http://www.ijhcs.com/index.php/ijhcs/article/view/2458.

Shaheen, F. (2013). Fluctuations in exchange rate and its impact on macroeconomic performance of Pakistan. The Dialogue, 8(4), 410-418. https://pdfs.semanticscholar.org/5281/f93284edff6d26fb6fd0a5678367652eb93e.pdf.

Socea, A.-D. (2012, Outubro). Managerial Decision-Making and Financial Accounting Information. Procedia – Social And Behavioral Sciences, 58, 47-55. http://dx.doi.org/10.1016/j.sbspro.2012.09.977.

Sousa, A. M., Noriller, R. M., Huppes, C. M. Lopes, A. C. V., & Meurer, R. M. (2018, Março). Relation between the macroeconomic variables and the stock return in companies of the finance and insurance sector from Latin American stock market. Revista Globalización, Competitividad y Gobernabilidad, 12(3), 20-30. https://doi.org/10.3232/GCG.2018.V12.N3.01.

Sui, L., & Sun, L. (2016). Spillover effects between exchange rates and stock prices: Evidence from BRICS around the recent global financial crisis. Research in International Business and Finance, 36, 459-471.

Vasconcellos, M. A. S. (2015). Economia: micro e macro. (6ª ed.). São Paulo: Atlas.

Yasser, Q. R., Entebang, H. A., & Mansor, S. A. (2011). Corporate governance and firm performance in Pakistan: The case of Karachi Stock Exchange (KSE)-30. Journal of economics and international finance, 3(8), 482-491.

Yildirim, A., & Gökalp, M. F. (2016). Institutions and Economic Performance: A Review on the Developing Countries. Procedia Economics And Finance, 38, 347-359. http://dx.doi.org/10.1016/s2212-5671(16)30207-6.

Zeitun, R., & Tian, G. G. (2014). Capital Structure and Corporate Performance: Evidence from Jordan. Ssrn Electronic Journal, 1-36. http://dx.doi.org/10.2139/ssrn.2496174.

Zhu, B. (2012, Novembro). The Effects of Macroeconomic Factors on Stock Return of Energy Sector in Shanghai Stock Market. International Journal Of Scientific And Research Publications, 2(11), 1-4. https://repository.au.edu/handle/6623004553/20960.